Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Over the past three days, Bitcoin has hovered between $103,000 and $104,500, creating a narrow channel after a notable rally that saw it break above $100,000 last week. Technical analysis of the daily candlestick chart shows the formation of a minor impulsive wave from $103,000, which may mark the final end of the recent consolidation and the beginning of a fresh rally towards new highs.

Notably, recent price action in the past 12 hours or so has seen the gradual end of the consolidation, and attention is now turning to the next psychological level at $110,000.

Analyst Sees Breakout As Signal For Upside Continuation

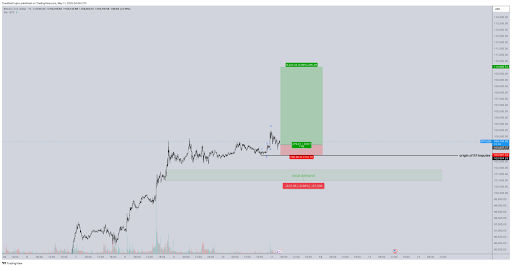

In a post shared on the social media platform X, crypto analyst CrediBULL explained the logic behind his current long trade setup, pointing out that Bitcoin has broken away from its three-day consolidation zone with an early impulse that started at the $103,000 level. His analysis predicted that this movement could be the start of a much larger leg upward, especially if the current price structure holds without falling back into a local demand zone between $101,000 and $102,000.

Related Reading

According to CrediBULL, the current trade has a clean invalidation level just below the impulse origin, allowing for a tight stop loss. This setup yields a high reward-to-risk ratio exceeding 5:1, with an upside target of $110,660, as illustrated in the chart. If this breakout is genuine, it could be a signal that Bitcoin is preparing for an aggressive push toward new all-time highs.

On the other hand, CrediBULL cautioned that if the current move proves to be a deviation and price falls below the impulse origin, focus should shift to the local demand zone around $101,800. The chart supports this with a clearly marked green area labeled “local demand.” This is the next major support if Bitcoin bulls fail to hold the current price levels.

$110,000 Bitcoin Target In Sight With Increasing Market Momentum

According to the crypto analyst, his prediction of the next move to $110,000 has at least a 20% chance of playing out. These odds are quite nice, considering the unpredictable nature of the crypto market.

Related Reading

Notably, price action in the past 24 hours has seen the leading cryptocurrency break above $105,000 again, peaking at an intraday high of $105,503 before easing slightly. This move strengthens the case that the recent consolidation phase may have concluded, and a successful move above $110,000 before the end of the week is underway.

At the time of writing, Bitcoin is trading at $104,428. A successful rally to the $110,660 target would represent a 6% gain from the current price, while downside risk is capped below the $103,000 level.

Featured image from Getty Images, chart from Tradingview.com