Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana (SOL) is currently navigating a challenging environment as the broader crypto market experiences a cooldown. After an impressive run earlier this year, momentum has slowed significantly, and SOL is struggling to reclaim the $160 level with conviction. The lack of strong demand has been evident in recent sessions, as buying pressure fades and volume remains low across major altcoins.

Related Reading

Despite this cooling phase, many investors remain optimistic. A growing number of market participants believe Solana could lead the next altseason once conditions stabilize and liquidity returns to the market. Historically, SOL has shown the ability to recover rapidly and outperform in bullish phases, making it one of the top contenders for explosive upside when sentiment shifts.

However, in the short term, caution prevails. Top analyst Carl Runefelt has highlighted a key technical development, noting that Solana might be on the verge of breaking a horizontal support zone. This event could trigger further downside in the near term. If this support fails, traders should prepare for increased volatility. Still, the broader consensus remains that SOL’s structural strength and ecosystem development position it well for long-term upside once macro conditions align.

Solana Faces Bear Flag Breakdown Risk As Uncertainty Grows

Solana has been locked in a tight range just below the $160 mark, struggling to reclaim key levels despite multiple attempts. For several days, momentum has faded, and with global markets under pressure, traders are bracing for increased volatility. The broader crypto market is losing steam as Bitcoin and Ethereum fail to sustain upward moves, which puts added pressure on altcoins like Solana.

Geopolitical tensions between the U.S. and China continue to weigh on investor sentiment, with ongoing tariff disputes and rising bond yields fueling macroeconomic uncertainty. The US bond market, in particular, is flashing signs of stress, adding to the caution in risk-on assets. If these conditions persist, altcoins may face a challenging period as capital retreats to more stable assets like Bitcoin or exits the market altogether.

Runefelt recently highlighted a key technical pattern on Solana’s chart—a bear flag forming around horizontal support. According to his analysis, this structure could break down any hour now, which would confirm the bearish setup and potentially send SOL down toward the $142 level. This target aligns with previous support zones and could act as a temporary bottom if the broader market stabilizes.

Despite the short-term risks, long-term sentiment around Solana remains cautiously optimistic. The network’s continued development and strong DeFi presence could fuel a recovery once market conditions improve. For now, however, traders are closely watching the $160 resistance and the $150–$152 support area, which could determine the next directional move. A clean break below support would likely trigger a wave of selling, while a reclaim of the $160 level could invalidate the bearish setup and open the door for a bullish reversal.

Related Reading

SOL Tests Key Support As Bearish Momentum Builds

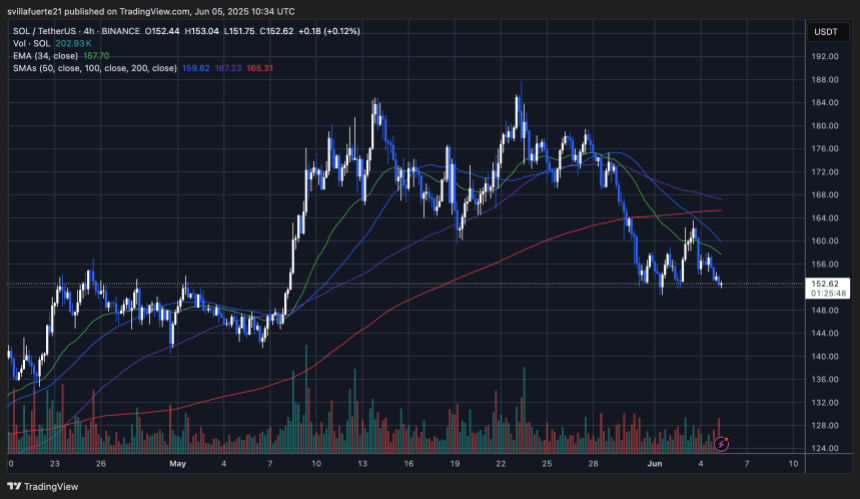

Solana (SOL) is currently trading at $152.62 on the 4-hour chart, testing a critical horizontal support zone as bearish momentum continues. The recent price action shows a clear downtrend, with lower highs and lower lows forming since the rejection from the $176–$180 area in late May. All key moving averages—34 EMA, 50 SMA, 100 SMA, and 200 SMA—are positioned above the current price, signaling short-term weakness and a lack of bullish momentum.

Volume has picked up slightly as price nears support, suggesting increasing market interest at this level. However, the failure to break above the 34 EMA (currently at $157.70) reinforces the view that sellers are still in control. The flattening 200 SMA at $165.31 and declining 50 SMA around $159.82 indicate that SOL must reclaim the $160–$165 zone to regain strength.

Related Reading

If the $150–$152 support range fails to hold, Solana could break down and target the next key support area around $142, in line with the projected move of the bear flag pattern identified by analysts. For now, bulls must defend this level to prevent deeper losses and keep hopes of a recovery alive in the near term.

Featured image from Dall-E, chart from TradingView